The installment saving service for your vacation budget

QOLLECT - The installment saving service

Project Overview

Qollect is founded as a capstone project of the Master of Science in Strategic Design and Management program at Parsons School of Design, The New School, New York.

The program is both academically rigorous and practice-oriented, providing hands-on experiences. We developed this project in Integrative studio II to explore innovative business opportunities. We applied a range of research methods, ideations, theoretical frameworks along with stakeholders through multiple iterations to

create a compelling, and comprehensive solution to the investigated area.

Project Duration: January -May 2019

Key Contribution: Design research, Branding, UX & UI Design, Research synthesis, Concept Ideation, Prototyping, Workshop facilitation.

Stage 1: Discovery & Background

Our research initially focused on the travel and tourism industry from our initial interests. We noticed how customer behavior changes in the travel industry through different accessible platforms and their online behavior.

The research was conducted through desk research and primary research including survey, interviews, shadowing and workshops. Although this research was focusing on the older generation, we noticed the travel obstruction is deeply related to income levels and their financial management across different age groups. Therefore, we reframed our focus toward travel behaviors and financial confidence;

How might we help people prepare their vacation under financial constraints or limited saving skills?

Stage 2: Synthesis & Ideation

Through this sensemaking process, we dived into the investigation and analysis of the current market space, adjacent space, competitors as well as the business model and operation of the competitors. We intended to examine all potential aspect that could connect to our theme.

We broke down the competitor analysis below;

Traveling related services include;

• Expense management platform

• Travel planning application

• Travel reward systems

Saving related services include;

• Online banking with saving goal

• Micro-saving platform

• Excessive money management

Commitment services include;

• Wellness challenges platform

• Commitment driven system

• Penalty contract application

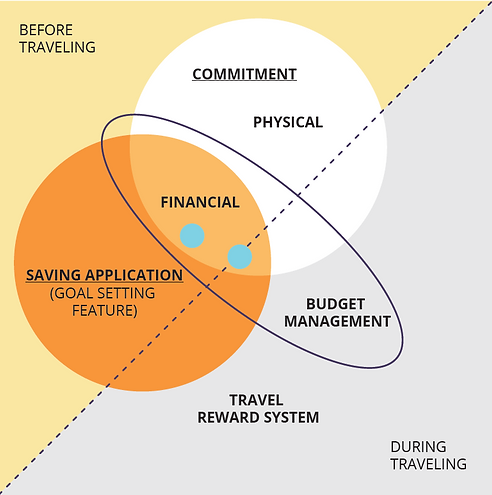

We identified two opportunities in the travel and financial service areas;

A holistic traveling service extended from trip planning to travel expense management which includes a preparation period and during the trip.

An encouraging commitment system from travel to budget saving with a consistent saving motivation for people to constantly pursue their goals.

We looked into the potential market size;

Percentage of people earn less than 50K and travel internationally at least once per year

<10%

Percentage distribution of annual household income less than 50K in the U.S.

40.8%

A study on the travel frequency based on income levels from Visa group (travel internationally at least once per year) reveals a low travel percentage on people earn less than 50K. However, the percentage distribution of annual household income less than 50K in the U.S is comparably high.

The key findings and insights are;

-

High flexibility is the main reason why customer avoid Certificate of Deposits (CDs)

-

Many people are unfamiliar with a recurring deposit system, the proper tutorial is needed

-

Fluidity is the preferred process

-

Efficient financial cash flow plays a significant role in sustaining the saving habit

-

The site system doesn’t favor returning user.

-

Many don’t have large enough sum to open the regular CDs or never know of this product

-

Co-saving with or saving for someone else motivate saving habits

Stage 3: Prototyping, Iteration & Testing

Prototype phase 1: Business model

We used the business model canvas to quickly sketch out the business concepts and examine that the ideas can be financially sustained. We brainstormed around the opportunities we found in the competitor analysis.

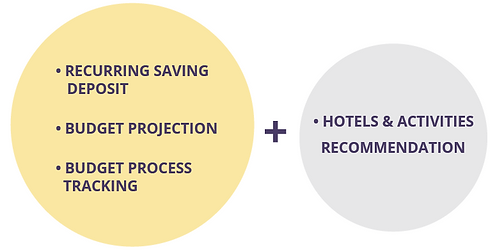

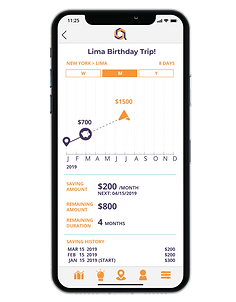

The final business concept is a service to help people fulfill their vacation through recurring small amount of deposit while offering a budget projection feature and saving tracking. We also provide a suggestion for hotels, and activities for users to have a holistic service.

Prototype phase 2: Product prototype

After setting down the initial business model, we started building website prototypes to test the business model and the website user experience with

our target users. we designed an online survey with the aims to understand the user's saving behaviors and their saving behaviors toward the traveling budget. We used the survey result to validate our installment saving product and budget projection feature.

Our website provides two data-embed calculation services: budget projection and saving plan setting.

Product iteration

We tested out our website with target users and revised the website flowchart, content and imagery up to 5 versions.

MAJOR FEEDBACK POINTS

• Term & Indication confusion.

Meal type

Hotel classification

Trip & Money save spots

• Too many navigation points.

• Pre-profiling like average income/ financial habit should be more accurate.

• Many people are unfamiliar with a recurring deposit system, the proper tutorial is needed.

• More casual and active lifestyle are needed while maintaining the security sense.

• The process of the package is unclear.

Market validation

We distributed the survey to 150 people around the U.S., asking them about their saving behavior and their interest in financial product or feature. The significant areas which helped us identify the target users were the average income, their average saving amount and duration.

Another section included potential customer incentives and preferred features. The results helped us pinpoint and prioritize the features and services that could benefit the end user.

Final product iteration

Prototype phase 3: Communication strategy

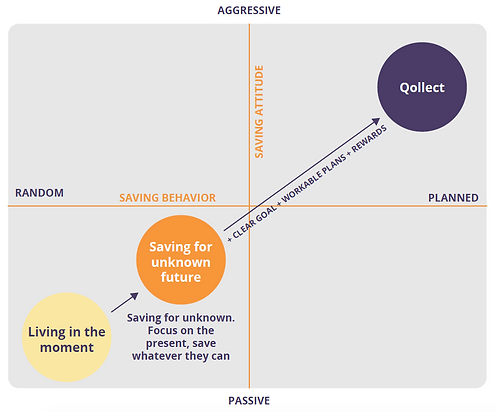

Some of the comments from the interviews showed us that people are well aware of the value in saving but uncertain with the method or in a different stage of consistent saving.

“I choose to save in case something happen I will have something to lean on.”

“ I should save money but my income is not that stable now. ”

“ Of course that saving is a must because you don’t know what will happen!”

“ Saving money so I can make any decision I want in the future. ”

“ I’m from a low-income family, I want to save money but it’s hard for me to save money now and there are a lot of things I want to do ”

In the audience segmentation, we broke down the pattern and construct the potential product position based on the customer's desire to change.

Stage 4: Marketing & Final implementation

Using the energetic art direction while carrying out the hopeful goal for the customer, we intend to encourage customers to use the service with assurance and peace of mind.

Two Main Marketing Channels:

Digital advertisement on Social Media

Physical advertisement at public commute spots