IN RELATION TO CRAFTER’S CONSUMING BEHAVIOR

CRAFT SUPPLIES MARKET RESEARCH

Introduction

The latest research from the Association for Creative in 2016 reports that the market size of Art & Craft industries worth $44 billion and growing each year. About 90% of industry sales heavily rely on brick-and-mortar retailers. Meanwhile, the most significant percentage of crafters (41%) are millennials, between the ages of 18-and-34 years old who spend a considerable amount of time online.

The research intends to examine the industry relationship between stakeholders, industry, and market space in order to identify the potential innovative business opportunities. The study used a design research methodology and design-driven practice to iterate a compelling comprehensive solution to the investigated area.

Key Contribution: Design research, Synthesis, Concept Ideation, Workshop facilitation.

Project Duration: August -December 2018

Timeline & Process

Phase 1: Research & Empathy

Initial Research Questions

• How might suppliers adapt to the millennial crafter consuming habits while keeping the authenticity of the crafting experience?

• What is the current system or pattern that suppliers have been adapted and how effective are they?

• How customer making/creating processes influence their consumer behavior?

• How can suppliers expose their products/resources to customers with the methods that resilient to future customer’s habit?

Potential Touch Points

• A requirement of physical contact

• Shipment cost & method

• Browsing & Personalization

• Assistance and support service

Quantitative Approach

Industry Overview

The Association for Creative Industries (AFCI) reports a steadily growing in the market in Art, Craft and creative industry in the United States since 2011. (The latest research was done in 2016). It is an age-old industry which is adapting to the merging market of the digital-based economy.

• The market is worth $44 billion as of 2017and growing between 9.5-10% each year

• Approximately 90% of industry sales are made at brick-and-mortar retailers

• Craft supplies are sold at approximately 75,000 retails around the U.S.

• Just 3-13% of consumers bought their supplies exclusively outside of a physical store.

Demographic & Behavior Overview

In 2016, The Association for Creative Industries (AFCI) conducted research from 10,000 U.S. residents and their household who participated in creative activities in 12 months.

-

33% or approximately 107.48 million of the U.S. population are considering themselves crafters.

-

63% of U.S. households participated in at least one creative activity in the past year.

-

16% of the crafters engage in one craft, while 39% participate in 2-4 and 45% are involved in 5 or more creative hobbies.

-

The most significant percentage of crafters (41%) are millennials, between the ages of 18-34 years old.

-

68% of women and 36% of men brought from specialty chain

-

71% of customer prefer to shop in-store (Hobby Lobby reports)

-

59% of people age between 18-34 claim that they have purchase supply online before

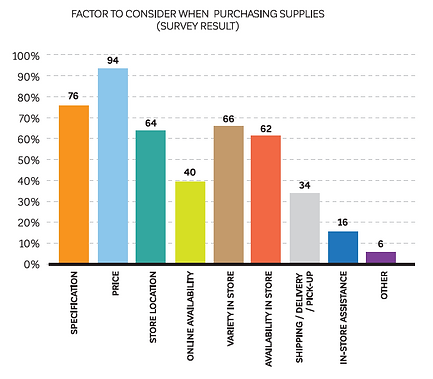

Survey overview;

107

surveys

78%

Female

18-60

years old

Qualitative Approach

The research focuses mainly on two undeniable stakeholders, craft supplier, and crafter. Part of the research will base on the recognizable people in the industry. While most of the research and analysis will be conduct through in-depth interviews and other observation methods in order to gather further thorough information on sites and from first-hand experiences. This quantitative analysis will help generate potential opportunity area and direction for future process.

Ethnographic

in-depth interview overview;

4

Specialty store staff

5

Millenial crafter

Key Discovery

-

The online store is needed, mostly due to conveniences for the customer but still not a preferred method for the customer

-

The time gap between ordering and delivery (Even with two days shipping like Amazon)

-

High risk (in customer mind) whether the product is correct or not.

-

The ability to reorder/or remanufacture inventory

-

Sale speed: Some inventories sale faster that doesn’t worth updated online.

-

-

Store rent is high, but it is an inevitable expense.

-

The online system requires high investment, (forever) back-ended maintenance and update.

-

For the physical store, the immediateness is one significant advantage, aside from physical contact with inventories.

-

Crafters tend to have browsing and collecting habit. They prefer to go through available choices before making a decision.

-

Ratings and Reviews are some of the key factors to attract customer to the store and service, less in term of the product itself.

Phase 2: Synthesis and Insights

Sensemaking process is the integrative data format, analyze from the quantitative and qualitative research. It is intended to categorize, synthesize and map out the findings and discoveries through a systematic approach and makes a better understanding among collected data. Through design research, it is beneficial to be familiar with data visually and learn how to adapt those synthesized data for further insights and project development.

Sticky notes cluster:

Helps organize and prioritize data for synthesis >>>>>>

Key Insights

-

The online selling platform is needed, but customers also expect the immediateness and physical contact on a product like in-store purchase

-

Some customer visited the store just to go buy the supply online.

-

Crafters tend to have browsing and comparing habit for a large variety of product. However, they prefer the convenience and quickly get what they think they want.

-

Stores only expect the customer to visit their space when some customers do not even know they existed.

-

Suppliers offer real human assistance at the store when many customers choose to rely on web inspiration and online tutorial.

-

Suppliers known the extensive specification of the product but only provide information to the customer when asked.

-

The online selling platform is needed, but most suppliers struggle with high investment.

Selected Insights

-

Stores only expect customers to visit their space when some customers do not even know they existed.

-

The online selling platform is needed, but the customer also expects the immediateness and physical contact on a product like in-store purchase

-

Crafters tend to have browsing and collecting habit for a large variety of product and knowledge. However, they prefer the convenience and quickly get what they think they want.

How might we question (Iteration)

How might we provide the craft supply and store details to millennial customers in a fast, accurately, and resourceful method?

Phase 3: Ideation & Concept

To further develop the business concept through the research,

co-creation and brainstorming workshop have been conducted. The idea of the workshop is to generate possibility, feasibility and innovative opportunity around the subject based on the research. The workshops aimed to approach the problem-solving process through lateral thinking, provide space for creativity and innovation as well as break down the false assumption and subject constraint.

Process & Tools

• Persona-based(reorder different needs) break down questions

• Roleplay

• Value/Impact Matrix

Ideation Workshops

Potential Concepts